Rule

Your

Mortgage

vs

Featured in

Help Centre

Chances are, the answers that you're looking for are already on our FAQ page

- To qualify for a MogoMortgage, you'll need a minimum credit score of 640, a minimum 5% down payment (that's from a legit source, no proceeds of crime), and enough income to make your monthly payments. They also want to make sure your property is something they feel comfortable securing the mortgage against (aka isn’t 1000 years old and dilapidated). Pretty standard stuff. Don’t worry our mortgage specialists will guide you through this entire process.

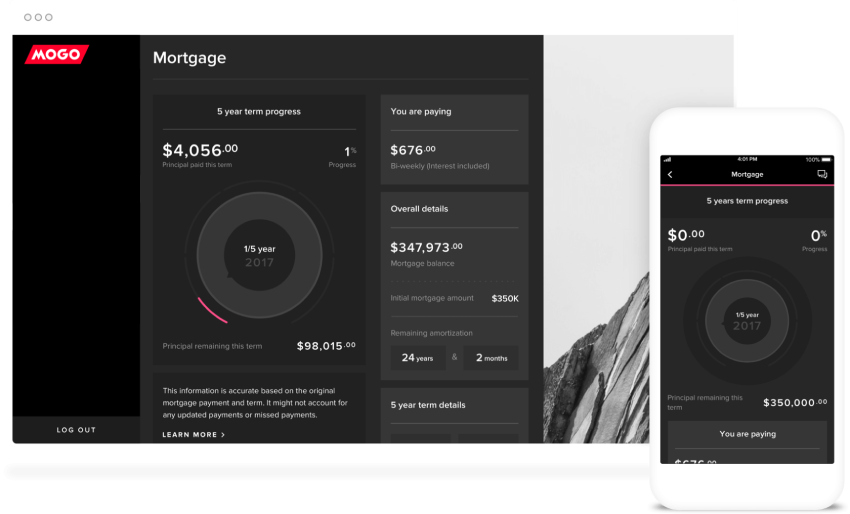

- We’re a broker, but a different kind of broker. We’ve built an experience that isn’t just about getting the mortgage, but also about having the mortgage. It takes a few weeks to get a mortgage, but you’ll have that mortgage for 25 years, so we thought: why not improve that part of the experience too?

- Right now, we've just launched our MogoMortgage experience, so we're offering mortgages where your down payment or home equity is less than 20% of your home value—aka. high-ratio mortgages.

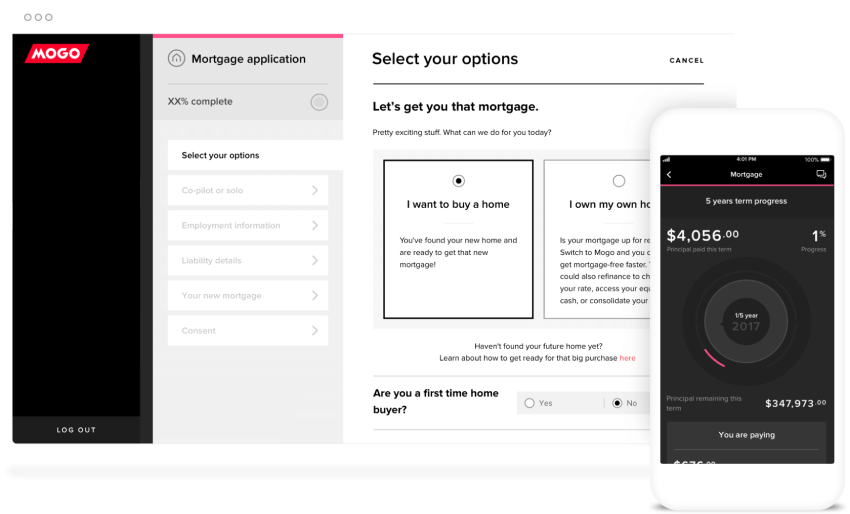

- If you're already a MogoMember, it's easy—just log in to your account and apply from your dashboard, under the MogoMortgage section.

If you're not a MogoMember yet, sign up for a free MogoAccount now to get started! (You'll get a free credit score with free monthly credit score monitoring... why not?) That's step 1. After you've opened a MogoAccount, you'll be able to apply under the MogoMortgage section and see the rest of the mortgage application.

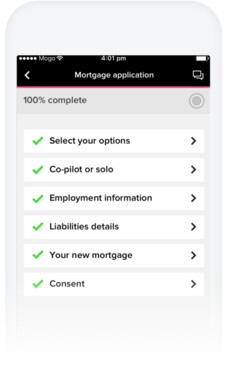

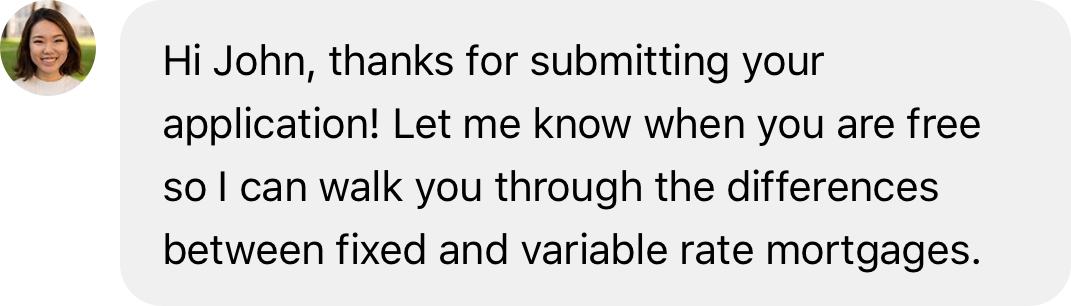

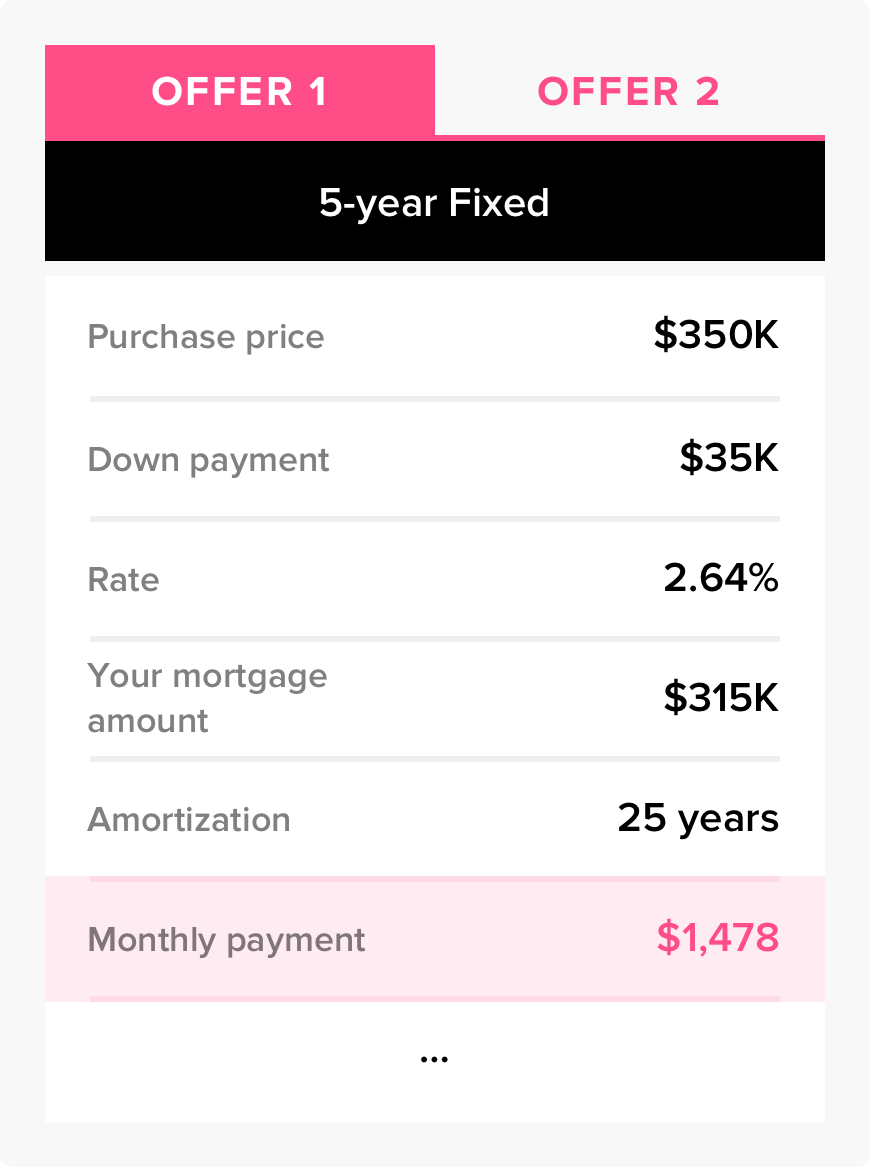

The application is a super simple online experience within your MogoAccount. Once you’ve completed it, we’ll set you up with a dedicated MogoMortgage Specialist. They’re on salary, not commission, so you won’t have to worry about awkward sales pitches. They’ll then reach out to you with next steps, review your options with you and be there with you every step of the way. No need to chase them down for info—you’ll get daily update emails and even get personal text messages keeping you up to date.

MogoMortgage is offered by Mogo Mortgage Technology Inc. o/a MogoMortgage (Ontario: FSCO License No. 12836) - Yes! Getting a pre-approval tells you how much can you afford—and shows the seller that you're serious about making an offer. It'll also prepare you for the documents that you'll be needing when you actually find a home.